In today’s environment of increasing market and geopolitical volatility, you may be thinking about how to navigate the current economic waters. And you may be wondering how professional investors are positioning their portfolios for the year ahead.

On March 1, 2019, at the Morgan Stanley Global Insights conference in New York, we polled leading investment professionals on their investment perspectives across asset classes, regions and sectors. In this article, we highlight seven key observations from this informal poll, keeping in mind that these observations are based on sentiment and not expert analysis. Where relevant, we also point out areas where the perspectives of Morgan Stanley strategists may differ from those of the conference participants.

1. Bullish on the S&P

Nearly 80% of investors at the New York conference anticipate that the S&P will round out the year at 2800 or above. Of note, these investors are more bullish than Morgan Stanley strategists, who see fair value somewhere between 2500 and 2800.

2. Cautious on risk exposure

Among the New York investors, 23% described their current level of risk exposure as ‘lower than normal’ versus 18% who described it as ‘higher than normal.’

3. Steering away from the UK and Japan

None of the investors at the New York conference chose the UK as their preferred equity region for the next 12 months, and only 3% are favorable on Japan. On the flip side, Morgan Stanley strategists see promise in European, Japanese and Chinese equities. And, part of the reason our strategists are bullish on European equity is exactly because it is so overlooked.

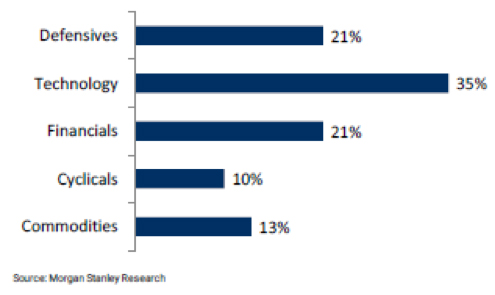

4. Preference for technology

The investors showed a bias toward technology, with 35% selecting is as their preferred global equity sector.

Figure 1. What is your preferred global equity sector for the next 12 months?

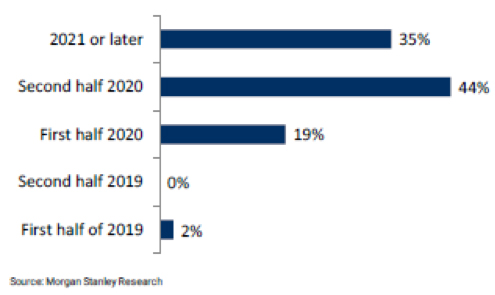

5. Split on timing of the next recession

While 35% of the investors believe the next US recession will be in 2021 or later, 44% believe it will happen in the second half of 2020. Where the vast majority of investors do agree is on the yield curve: 75% expect the yield curve to invert before the next recession and 95% of them expect the next recession to start within two years of that inversion.

Figure 2. When will the next US recession start?

6. Consensus on greatest disruptions

The investors at the New York conference view economic nationalism and the shift from a unipolar (US) to a bipolar (US/China) world as the biggest potential disruption risks to the global economy.

7. Optimism about quant investing

Investors foresee a number of promising avenues for quantitative investing in 2019, with expansion into new asset classes, use of alternative data and application of advanced methodologies leading the way.

For more insight on key investment themes or guidance on how to address them within your portfolio, speak to your Morgan Stanley financial adviser. Plus, more Ideas from Morgan Stanley’s thought leaders.