Over the years, you may have heard investment pundits murmuring that the rapid growth in the ETF market could possibly foreshadow a collapse akin to an apocalypse. In this article, we dispel five common myths about ETFs.

Exchanged Traded Funds (ETFs) are a subset of a broader category of Exchange Traded Products (ETPs), which also includes Exchange Traded Managed Funds and Structured Products. ETFs are marketable securities that track a stock index, a commodity, bonds or a basket of assets. Unlike unlisted managed funds, ETFs are traded like common stock on an exchange.

Myth No. 1: ETF liquidity is limited to what appears on a trading screen

To appreciate the layers of liquidity available through ETFs, it is important to understand how an investor would buy an ETF:

In Australia, an ETF issuer must have an agreement with a market maker before it can begin trading. The market maker provides liquidity by acting as both a buyer and seller of ETF units, and typically displays only a small fraction of the volume they’re willing to trade on a broker’s screen. The authorised participant, generally a large financial institution, also provides liquidity with its ability to exchange baskets of shares for units in an ETF with the ETF issuer. The chart above illustrates that there are two layers of liquidity available to the investor—the market for ETF units and the underlying sharemarket itself.

Myth No. 2: ETFs introduce additional cost through wider trading spreads

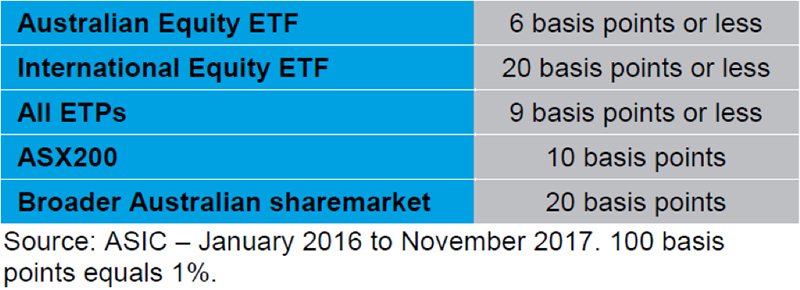

In fact, in a report recently published by the Australian Securities & Investments Commission (ASIC), bid-ask spreads are typically comparable to outright share trading.

Myth No. 3: ETFs introduce additional risk through the potential for the failure of the issuer

The vast majority of ETFs in Australia operate under a trust structure which segregates the assets of the fund from the assets of the issuer. In this situation if the issuer fails, the ETF’s assets are not part of the issuer’s assets and, thus, are not available to creditors. The Trust would continue to operate for the benefit of its unitholders. The Responsible Entity would be replaced and the Trust would continue as usual. Alternatively, the ETF could be wound up and the assets would be returned to unitholders.

Myth No. 4: Timing doesn’t matter when trading ETFs

ETF pricing fluctuates during the day and could be more volatile right after the market opens and right before it closes. For ETFs with international assets, all else being equal, it is generally preferable to trade these in the afternoon. However, this strategy may not be helpful for ETFs with underlying assets in Europe and the US, as the Australian equities market is always closed when those markets are open.

Myth No. 5: Passively-managed ETFs will introduce distortion in the market

Some investors are concerned that, if passively-managed ETFs take over, they will introduce distortion in the market because investment decisions will be made according to market weight, rather than fundamentals. In our local market, ETF trading was less than 3% of the daily volume on the ASX in October 2018, compared to 30% in the US, where recent research has showed that the index effect has been dampened by the rise of ETFs.[1]

Key Takeaway

Our view remains that ETFs can be an efficient method of gaining exposure to a broad range of assets. Keep in mind that an ETF is only as good as the assets it holds, so if you are considering an investment into an ETF it is important to understand its components, as well as the total cost of ownership.

For more on ETFs and which assets and asset classes may be right for you, speak to your Morgan Stanley financial adviser or representative. Plus, more Ideas from Morgan Stanley's thought leaders.

[1] Financial Times. ETF rise helps damp down market distortions, research finds. Published November 23, 2018. Available at https://www.ft.com/content/d8fbd9ab-24d4-35bc-8605-53fd165facf5.