Consumers continue to spend more time with new media, digital and mobile, and less time with old media, print, TV and radio. Is industry consolidation the answer to compete with global media and technology companies?

Advertising revenue is cyclical in nature. It is linked to GDP growth, business and consumer confidence, business profitability and consumer spending.

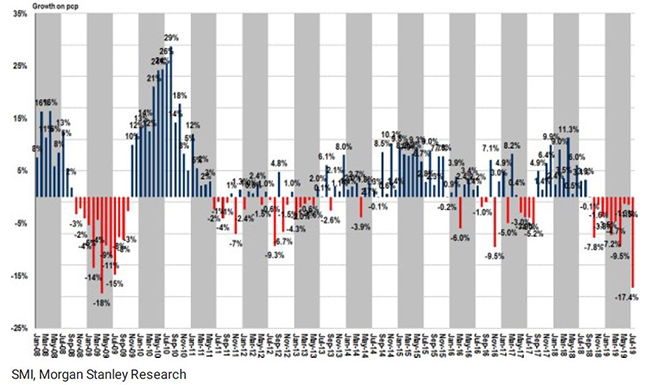

Based on advertising data from the last 50 years, Morgan Stanley Research estimates that Australia suffers an advertising recession approximately once every decade. This is based on a recession defined as at least two consecutive negative six-month periods, where advertising spend declines at least 5% on the previous corresponding period.

Where are we in the advertising cycle?

Morgan Stanley Research believes the Australian advertising market is currently in the midst of a shallow advertising recession.

The last negative advertising year was after the global financial crisis in 2009, when total advertising spend in Australia declined by an estimated 8% for the full 12 months. Since then, there were nine consecutive years of positive year-on-year growth in total advertising spend from 2009 to 2018. But that unbroken trend has come to an end.

Total Australian adspend ... now 11 consecutive months of negative year on year growth - since September 2018

Structural change continues at a fast pace

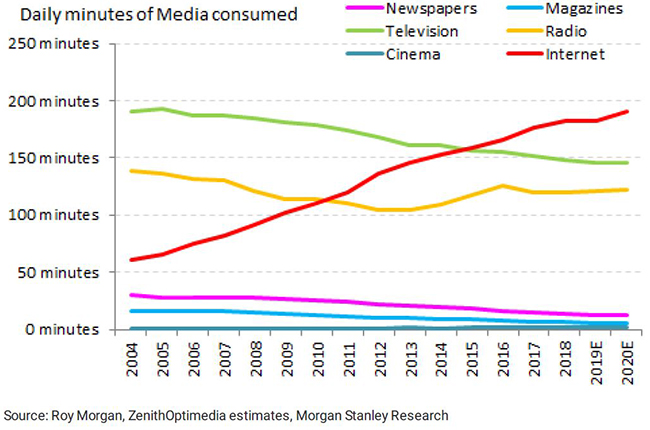

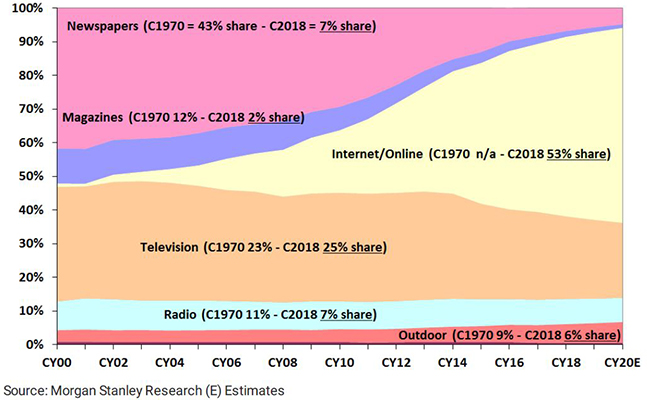

The rate of change in how Australians consume media is accelerating. Consumers continue to spend more time with new media: digital and mobile, and less time with old media: print, TV and radio. These trends are expected to continue, which also presents negative earnings risk for traditional media as global online players dominate advertising revenues.

However, internet and digital companies or those with positive structural change are not immune to an economic downturn, which was seen in 2008-2009.

Changing composition of media consumption in Australia

Changing composition of adspend Australia

Media industry consolidation is underway

When examining the Australian media industry, one of the key themes to consider is the regulatory environment, as it directly influences the market value of TV, radio and newspaper assets.

The most recent significant change was the relaxation of media ownership laws. After a long period of negotiation, the Broadcasting Reform Bill passed through Parliament to become legislation in October 2017. The major changes were:

Removal of the 75% audience reach rule, which had prevented a TV broadcaster from having direct reach to more than 75% of the Australian population.

Removal of the 2-from-3 rule, which had prevented one person from controlling two out of three media platforms in a single market – newspapers, TV and radio.

Removal of TV and radio licence fees and replaced by much smaller "spectrum fees".

The passing of this legislation has made it easier for media companies to consolidate. Since the law changes, there have been several major media M&A events. Any material weakness in the advertising market and associated earnings could prove a catalyst for further industry consolidation, which is why Morgan Stanley Research expects more media M&A activity to occur in Australia going forward.

M&A activity and consolidation across the media industry in Australia could be a good move for some. While it won’t fix the severe structural challenges facing the industry, such as audience and revenue declines, it could offer scale to better compete with global media and technology companies.

Outlook for the advertising industry

In Australia, advertising has enjoyed positive year-on-year growth every year since 2009 and Morgan Stanley Research continues to forecast above-average earnings per share growth for some of the internet and digital media stocks.

However, at this point in time, the advertising cycle remains weak especially for the traditional media stocks, such as TV, newspapers, and radio, which have been impacted by negative structural changes. Falling audience and engagement could mean lower revenues, lower earnings and ultimately lower asset values. Over the medium term, margins and returns are expected to decline.

It’s important to note advertising-based media is a cyclical business. When revenues turn negative and costs are largely fixed, the operating leverage and impact on EBITDA and bottom-line earnings per share can be very material.

Morgan Stanley Research continues to be more cautious about overall advertising growth prospects until 2021.

For more on the advertising industry, or a copy of our full report, speak to your Morgan Stanley financial adviser or representative. Plus, more Ideas from Morgan Stanley's thought leaders.