The ongoing trade tensions are pushing corporate confidence and global growth to multi-year lows. Are we about to enter a global recession?

This article is a summary of a publication from Morgan Stanley Research.

Trade tensions have escalated again in late August 2019, with additional tariffs recently announced by both the US and China. If implemented as scheduled, it could bring yet another dent to global growth.

Although an escalation in trade tensions will likely usher in further easing, both monetary and fiscal policies have largely been reactive, and this may not be enough to drive a recovery.

Chipping away at global growth

Global growth has already decelerated to just 3.0% year over year in 2Q19, with trade tensions being the key drag on corporate confidence, capital expenditure and trade.

If the tariffs announced on August 23 are implemented as scheduled, Morgan Stanley Research see global growth decelerating to 2.6% year over year in 1Q20. This would mean that global growth will average just ~2.7% year over year for the four quarters ending 2Q20, inching closer to the global recession threshold of 2.5% year over year annual average growth.

Global growth to inch closer to recession threshold

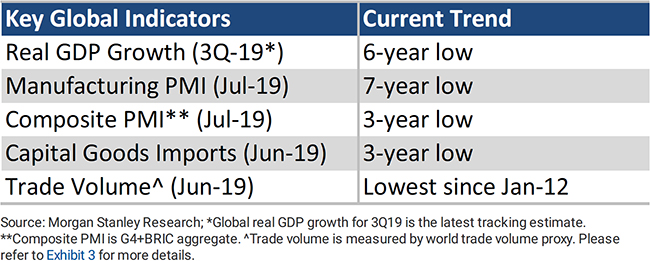

Key global indicators are at multi-year lows

Manufacturing PMI has been weakening and is contracting for the second consective month

Employment sub-index of manuacturing PMI has slipped into contractionary territory

Global retail sales growth is close to cycle lows

Corporate confidence and business investment remain the key channels of impact

As tariffs on the remaining imports are implemented, corporates could continue to face downward pressures on demand, margins and profitability. Slower global growth may impact profits from international operations and create headwinds for commodity producers. In recent months, Morgan Stanley Research have also observed that the effects of the global slowdown are broadening, and the impact is showing up in the non-manufacturing sector as well as the labour market.

Furthermore, trade activity, an important data point to gauge the health of the global economy, reached the lowest point since 2012.

Global trade volume has reached the lowest point since 2012

Can policy easing save this cycle?

In response to the downside in global growth and lingering trade tensions, central banks globally have moved into easing mode. They are likely to provide additional monetary policy support in the months ahead. To some extent, the dovish shift in central banks has helped to reduce the risks of a non-linear tightening in financial conditions.

While these measures may be helpful in containing downside risks, it may not be enough to drive a recovery until trade policy uncertainty goes away. The effects of easing may be dampened by weak confidence and could also impact the economy with lags.

Is a global recession on the horizon?

Morgan Stanley views the risks of further trade tensions escalation as meaningful. If the US raises tariffs on all imports from China to 25% and China makes a matching response with these measures staying in place for four to six months, we could enter into a global recession in six to nine months.

However, while trade tensions are the dominant global overhang on the outlook, they aren’t the only one. In our bear case, a non-linear tightening of financial conditions could be also triggered by the emergence of a country-specific adverse shock such as a no-deal Brexit, the emergence of funding risks in select emerging market economies and other geopolitical tensions.

For more on the trade tension escalations, or a copy of our full report, speak to your Morgan Stanley financial adviser or representative. Plus, more Ideas from Morgan Stanley's thought leaders.