Morgan Stanley believes sustainable finance is not an isolated phenomenon, but an evolution that is going to continue.

Matt Slovik, Morgan Stanley’s Head of Global Sustainable Finance, recently spoke at Morgan Stanley’s Disruption Evolved Webcast Series – ‘Beyond Guilt. Investing in Sustainability’ about the trends we’re seeing in the sustainable finance space.

Sustainable investing continues to accelerate

The market for sustainable finance has changed a lot in the past decade.

“Around the world today, one in three dollars is invested through some sort of sustainable lens,” Matt said.

This is a 73% increase since 2014 and it’s not a unique geographic pattern.

“Europe has been leading the charge, with the US and North America close behind. Australia and Asia have been growing rapidly over last few years.”

Morgan Stanley believes this is not an isolated phenomenon, but an evolution that is going to continue.

“As a Firm, we’ve been looking at sustainable finance for a long time,” Matt said.

“We are serious about sustainable finance, and our team was formed to drive sustainability across our businesses and across our products, looking into how we serve clients. We serve as a connector of sustainability expertise to help deliver innovation on behalf of clients.”

Exhibit 1: Globally, one in three dollars is invested sustainably – a 73% increase since 2014

Sources: GSIA 2018 Trends Report (Global Sustainable Investing Alliance), Morgan Stanley Institute for Sustainable Investing, “Sustainable Signals: New Data from the Individual Investor,” 2019; Morgan Stanley Institute for Sustainable Investing and Morgan Stanley Investment Management, “Sustainable Signals: Asset Owners Embrace Sustainability,” 2018; Morgan Stanley Institute for Sustainable Investing, “Sustainable Signals: ‘Growth and Opportunity in Asset Management,” 2018.

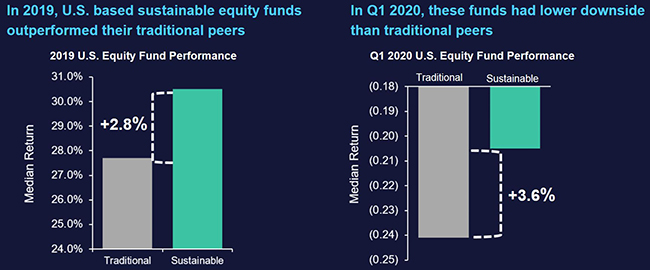

Exhibit 2: Sustainable investing continues to perform in good times and bad

Note: Data and definitions based on Morningstar Direct (2019), which defines sustainable funds are those that use ESG criteria to evaluate investments or assess their societal impact

Source: Analysis from Morgan Stanley Institute for Sustainable Investing, “Sustainable Reality: Analyzing Risk and Returns for Sustainable Funds,” 2019.

“The number one myth in sustainable investing is around performance – that traditional funds outperform sustainable funds. In reality, however, the returns of sustainable and traditional funds have been similar. In fact, sustainable funds have generally provided investors with decreased risk relative to traditional funds.” Matt said.

Future Environmental, Social and Governance (ESG) trends in near term

Sustainable investing is likely to become a larger focus for many individual investors and companies, with an evolution towards ESG data-driven insights and the understanding of its tangible impacts.

“Over the last several years, ESG data has improved, but there is now an increasing emphasis on how to translate the data into meaningful and material decision making,” Matt said.

As well as seeking strong performance, issues surrounding the ‘S’, (social), has been brought to life, especially in the wake of the COVID-19 global pandemic. For instance, companies are thinking about their resilience and how they can build that resilience into their operations and welfare of their employees.

Impact investing

While impact investing is, by definition, about achieving positive environmental or social outcomes, Morgan Stanley’s approach has always been unapologetically performance-driven. Our focus is on fund managers and private equity that invest in impact sectors. These include education, health care, financial services and climate solutions where they can help build a market and deliver important and basic services.

“There has been much attention on impacts including reducing carbon emissions, creating renewable energy, creating quality jobs for female employment, and access to education and healthcare, which are all important and high value for customers,” Matt said.

“If we can get it right, we can have meaningful impact. And returns go hand-in-hand.”

Sustainability and ESG: C-suite and Board issues

In a time where sustainable investing is growing rapidly, many companies are active in this space. So how do we filter out companies that say they are focusing their efforts on sustainability but are simply doing things they normally do? How do we identify ‘green washing’?

“It comes down to authenticity and cutting through the noise. It may be hard but it is about asking the right questions to peel back the layers and asking for examples,” Matt said.

“For instance, ask how this is adding value, whether it is in their operations or investment selection.

“Sustainability and ESG are now increasingly C-suite and Board issues. You need to assess how engaged the senior leadership really is, and whether they can answer the questions at an earnings update.”

It is also no secret that corporate sustainability is becoming an important part of brand identity.

“More people are interested in what they’re doing to tackle sustainability and ESG impacts, and how they’re approaching it. Finance has entered the realm of helping brands communicate this message, which may have not historically been a part of the storyline.”

Everyone has a different approach to sustainability

There is a hungry group of sustainability-focused investors who are looking for opportunities to invest in companies or sectors, where historically it may have not fit their mandate, approach and goal.

“It’s important to remember each client has different objectives, so as a Firm, we look at a spectrum of opportunities. We have a framework in place that goes from negative screening, ESG integration, thematic investment focus to impact investing. These approaches do mix sometimes but it’s a useful framework,” Matt said.

For more on sustainable finance, speak to your Morgan Stanley financial adviser or representative. Plus, more Ideas from Morgan Stanley's thought leaders.