Morgan Stanley recently updated its macro and market assumptions for 2024 and 2025. We present the key takeouts and implications for Australian Investors.

SUMMARY

Overall, a clearer path of disinflation, growth, and policy over the next few months is likely to establish a constructive outlook across both Equity and Bond markets. We expect the global economy to be characterised by stable growth and moderate disinflation across our forecast horizon through to 2025, allowing rate-cutting cycles to begin in most Developed Markets (DM). Domestically, fiscal stimulus is expected to drive an improvement in activity through the second half of 2024 but also keep inflation above target. The Reserve Bank of Australia (RBA)'s less-restrictive monetary policy settings will be challenged, but ultimately we expect interest rates to remain on hold before easing in early 2025 when labour market weakness is more evident.

MACRO OUTLOOK

Growth outlook

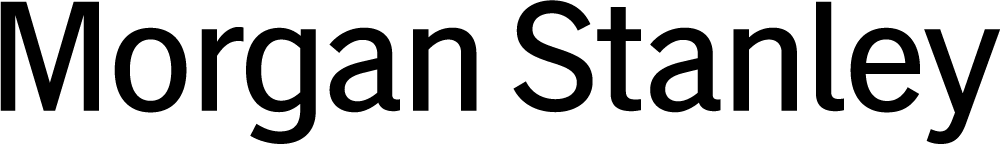

Overall, we expect the global economy to be characterised by stable growth and moderate disinflation across our forecast horizon through to 2025. Tight monetary policy will likely continue to slow growth, even as rate-cutting cycles begin. We expect 2024 to continue to be volatile, as the global economy struggles to shift to a slower ‘gear’, reminiscent of the mid-1990s and the last time the Federal Reserve (Fed) engineered a ‘soft-landing’. Morgan Stanley sees global GDP holding steady at just over 3%Y, which is similar to 2023 except that the mix of US versus ex-US growth differs.

Figure 1: Global growth trends are divergent even as inflation is convergent

US

In the US, we forecast a slower but solid pace of growth. The slower pace reflects constrained private demand amid tighter than expected monetary conditions as the policy rate remains higher for longer. The positive supply shock from immigration allows continued solid job growth and consumption, even as inflation continues to moderate. We expect GDP growth of 3.1% 4Q/4Q in 2023 to slow to 2.1% 4Q/4Q in 2024.

Europe

In the Euro area, we see modest growth acceleration in 2024 and this will likely be followed by an improved 2025. Fiscal consolidation and restrictive monetary policy are key headwinds for growth while positive real income gains, on the back of a robust labour market, will likely benefit the services sector. However structural challenges, including demographics, productivity and energy transition remain. In the UK, we expect growth momentum to remain solid with an expected recovery in external demand as well as lower policy rates, and we forecast 0.7%Y growth in 2024 to improve to 1.2%Y in 2025.

Asia

Broad-based wage growth with structural labour market tightness means the inflation that started with imported commodities has become a virtuous cycle of wages and inflation in Japan. In China, a recovery in exports and modest supply-side policy have led to higher-than-target real GDP growth in 1Q24, but with a continuation of deflation. The continued focus on deleveraging in both housing and local government financing vehicles means that the real GDP growth will likely fall just shy of target. We expect 4.8%Y growth in 2024, followed by 4.5%Y in 2025 as a debt-deflation cycle with a soft labour market continues to suppress domestic demand.

Australia

On the macro side our economists expect GDP growth will improve sequentially through 2024, although remain below trend. Income tax cuts mid-year are a key driver boosting household incomes by 1.3% and increasing consumer spending. The labour market, particularly over 2H24, remains the key variable for the economic outlook in terms of determining whether the forecast improvements in household incomes are spent. We foresee the unemployment rate rising through the course of 2024 and 2025. Despite this, we expect wage growth will ease only gradually.

Inflation outlook

Inflation continues to decelerate globally, and low inflation is sustained even in the context of improving growth. Overall, while lower energy prices help inflation levels ease towards 2%Y in DM economies, core inflation is slightly more inertial.

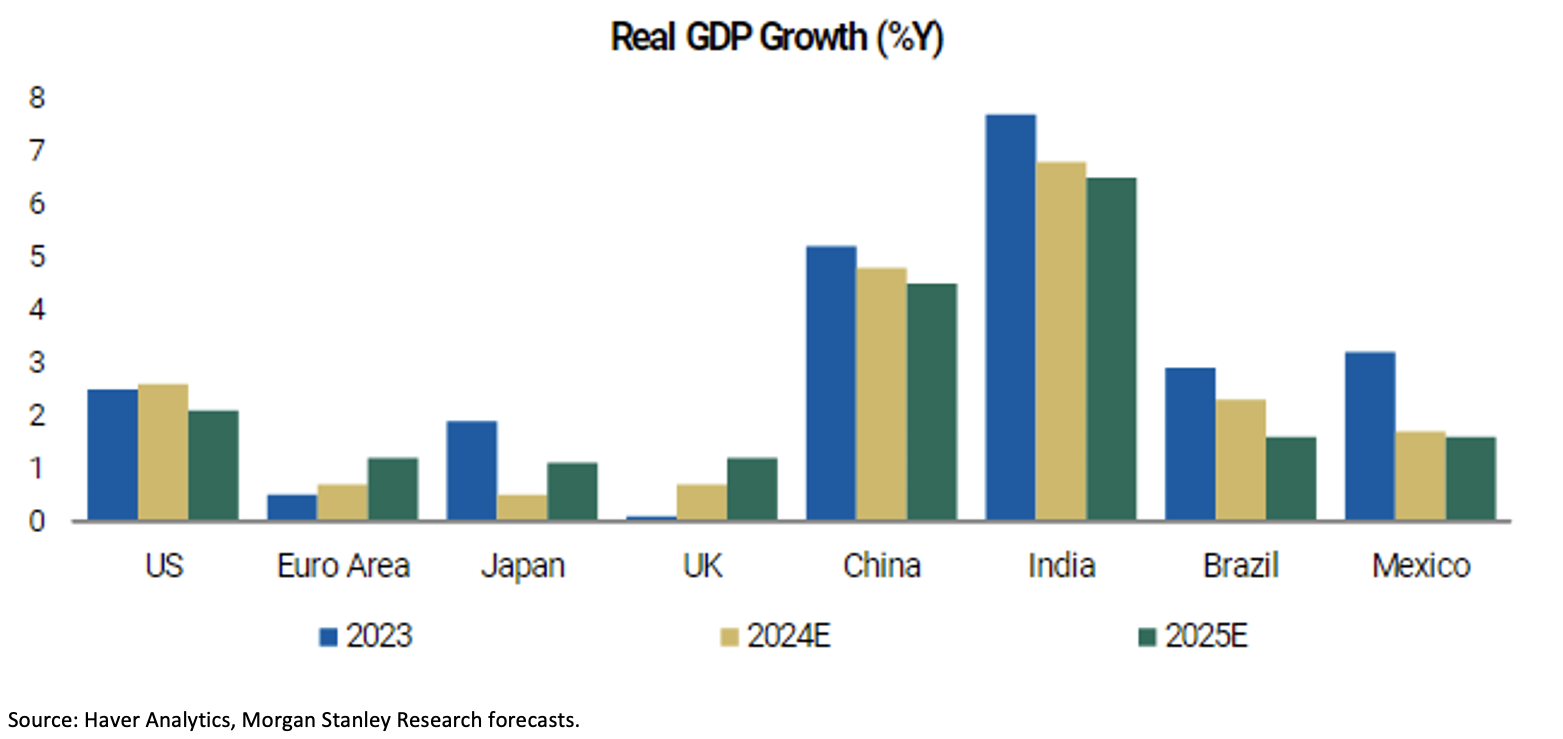

In the US, headline inflation has moderated, particularly as commodity prices have stabilised throughout 1Q24. With inflationary pressures on a downward trajectory, we expect inflation to reach close to the Fed’s 2% target by 2025. In the Euro area, we expect core inflation to be close to target in 2025. However, disinflation will likely be ‘bumpy’ due to energy prices. We forecast headline inflation at 2.4%Y in 2024 and 2.2%Y in 2025. The UK is expected to see inflation converge back to target in 2024 and potentially as early as 2Q24.

Figure 2: Data on rents continues to point to a deceleration in US shelter inflation in 2H24

Japan has exited its deflationary equilibrium and the virtuous cycle between wage and prices means a higher nominal equilibrium. Japan’s inflation should remain above the Bank of Japan’s 2% target in 2024. Similarly Australia will take longer to get inflation back into the target range. We forecast core inflation will move back into the RBA's 2-3% target range in 2025 as the labour market cools.

In Asia we see a disinflationary ‘drag’ from China and forecast sub-1%Y inflation through 2025, bringing regional inflation levels near 2%Y over the same horizon, with India the exception.

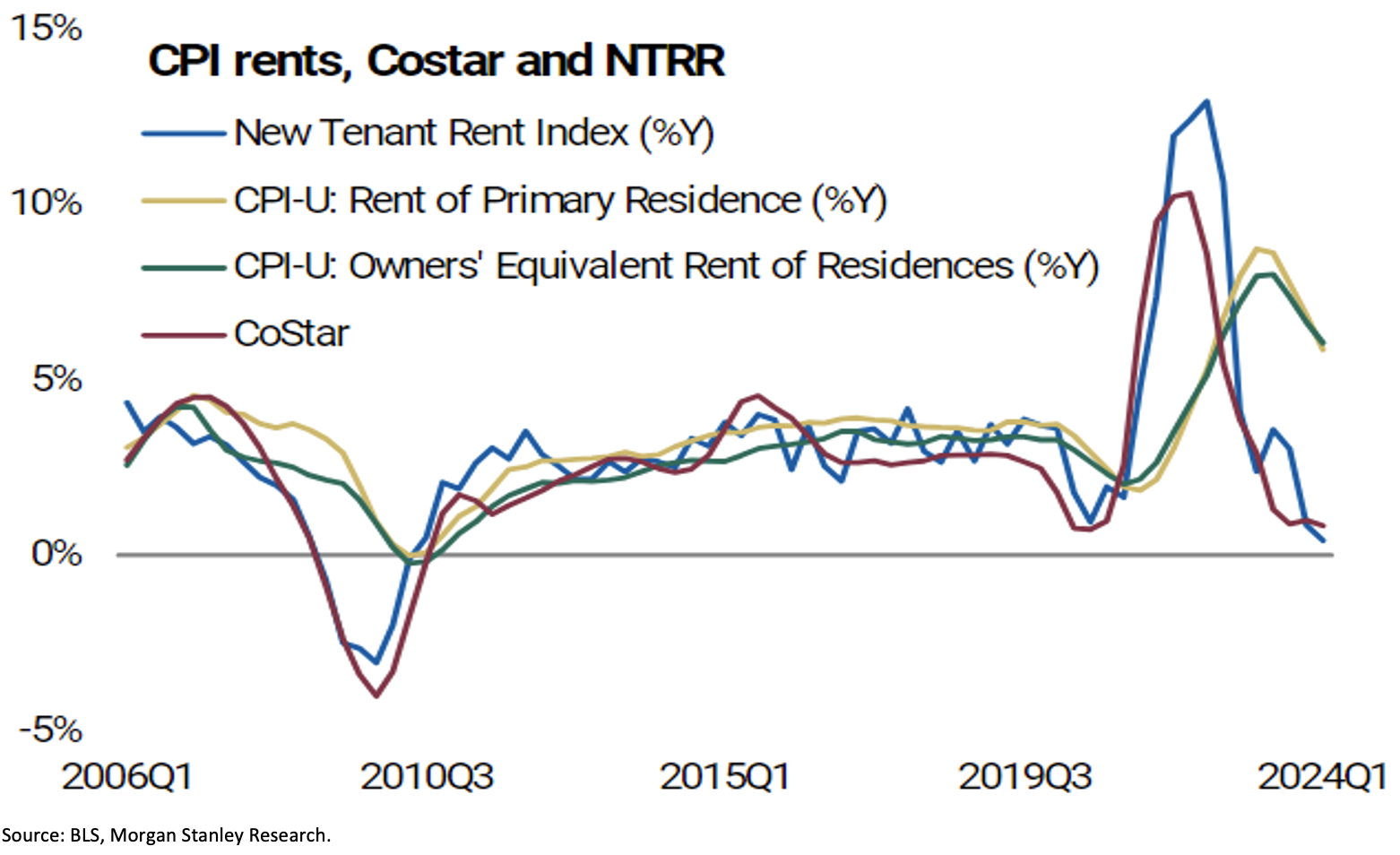

Monetary Policy Outlook

In DM central banking, we anticipate both the European Central Bank and Bank of England to lower interest rates in June on the back of inflation likely approaching target by the end of the year. Meanwhile, core inflation at 2.7% Q4/Q4 is enough for the Fed to cut three times in 2024 as the downward path will be evident. Across Emerging Markets (EM), we believe that the degree of policy easing is limited by the level of the Fed’s policy rate.

Figure 3: Gradual monetary easing expected except for Japan

Domestically, fiscal stimulus is expected to drive an improvement in activity through 2H24 but also keep inflation about target. The RBA’s less-restrictive policy settings will likely be challenged, but ultimately the central bank remains on hold before easing in early 2025 when labour market weakness is more evident.

CROSS ASSET VIEWS

Equities

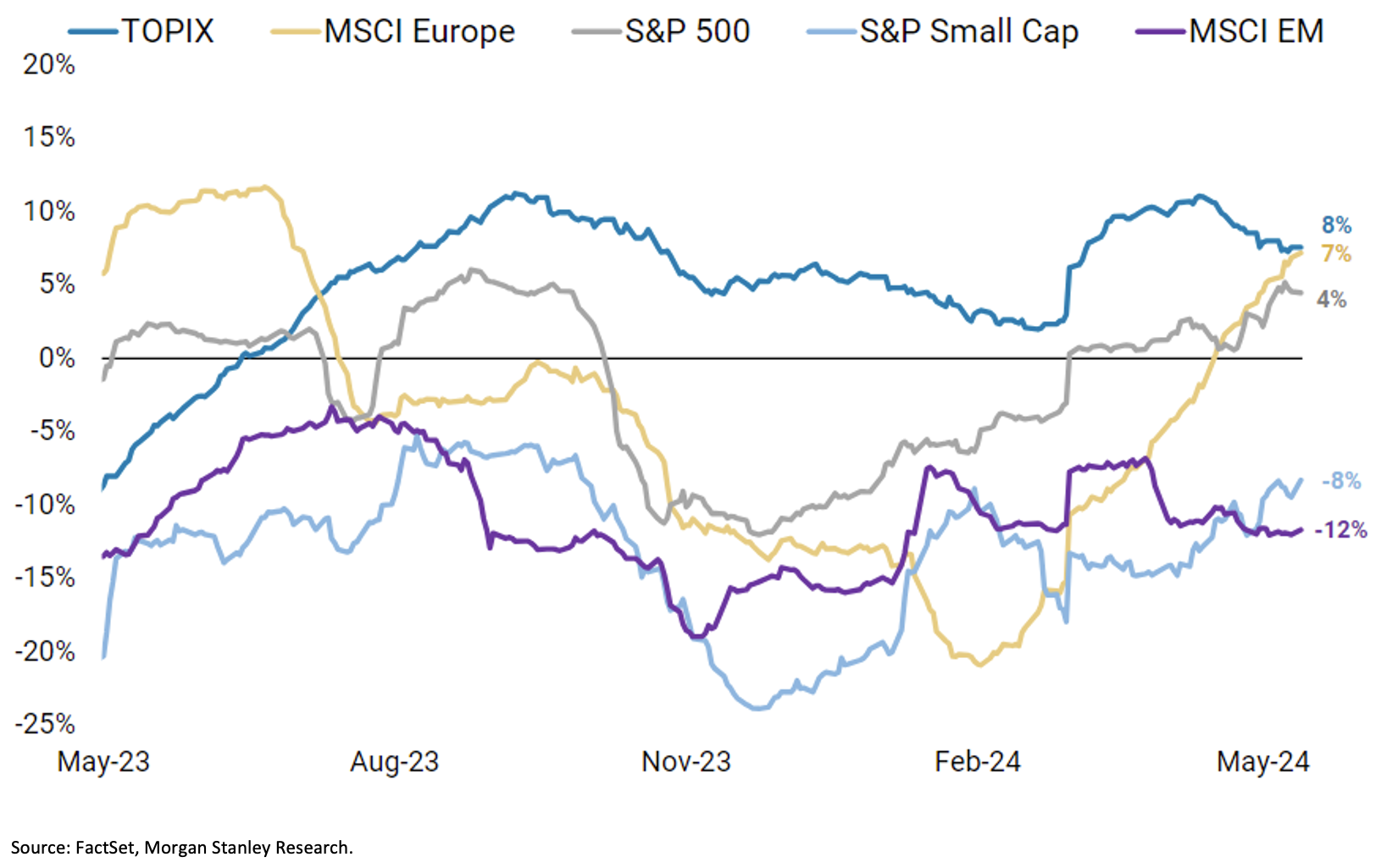

After a challenging year for global (excluding Japan) EPS growth in 2023, we see an earnings rebound in 2024 driven by a combination of cyclical (i.e., a return of positive operating leverage) and structural (i.e., artificial intelligence) diffusion drivers. Notably, we forecast 8%+ EPS growth across the US, Europe, Japan, and EM in 2024 and 2025. Interestingly, within the US, there is a notable divergence between resilient EPS revisions for large caps and weak revisions for small caps. This disparity is supportive of our US strategists' relative preference for large caps over small cap stocks.

Japanese forward equity multiples at ~15x are high relative to history, but the return on equity improvements means that history may not be the right benchmark at this point. In particular, valuations for most markets, except the US and in Credit, don't look particularly ‘stretched’.

Europe and Japan are our most preferred regions on the back of strong earnings revisions and attractive relative valuations. We remain Equal-weight in the US. Our strategists have recently raised their S&P 500 12-month price target to 5,400 amid robust EPS growth alongside modest multiple compression. In particular, we remain favourable on the Quality factor. EM remains an Underweight exposure amid Asia growth risks, even as we see specific sectors/markets as compelling as well as specific thematics (e.g., India, Korea/Taiwan Technology).

Figure 4: The strongest EPS revisions are in Japan and Europe

Finally in Australia our strategists have lifted their price target for mid-2025 to 8100 for the ASX 200. We note the recent repricing for rates to remain higher for longer is linked to stronger growth as opposed to significant reflation risk and a return to rate hikes. In addition, the large gap in performance of Resources stocks to Banks is likely to start reverting.

Government Bonds

We recommend an Overweight duration stance towards most government bonds. With eight of the G10 central banks expected to have started lowering policy rates ahead of the US election, our Fixed Income strategists believe that most investors in government bonds will close underweight duration positions after the US Labor Day holiday. In Australia, we see the yield curve gradually drifting downwards as lower yields in 2025 and 2026 roll into the 2-year window.

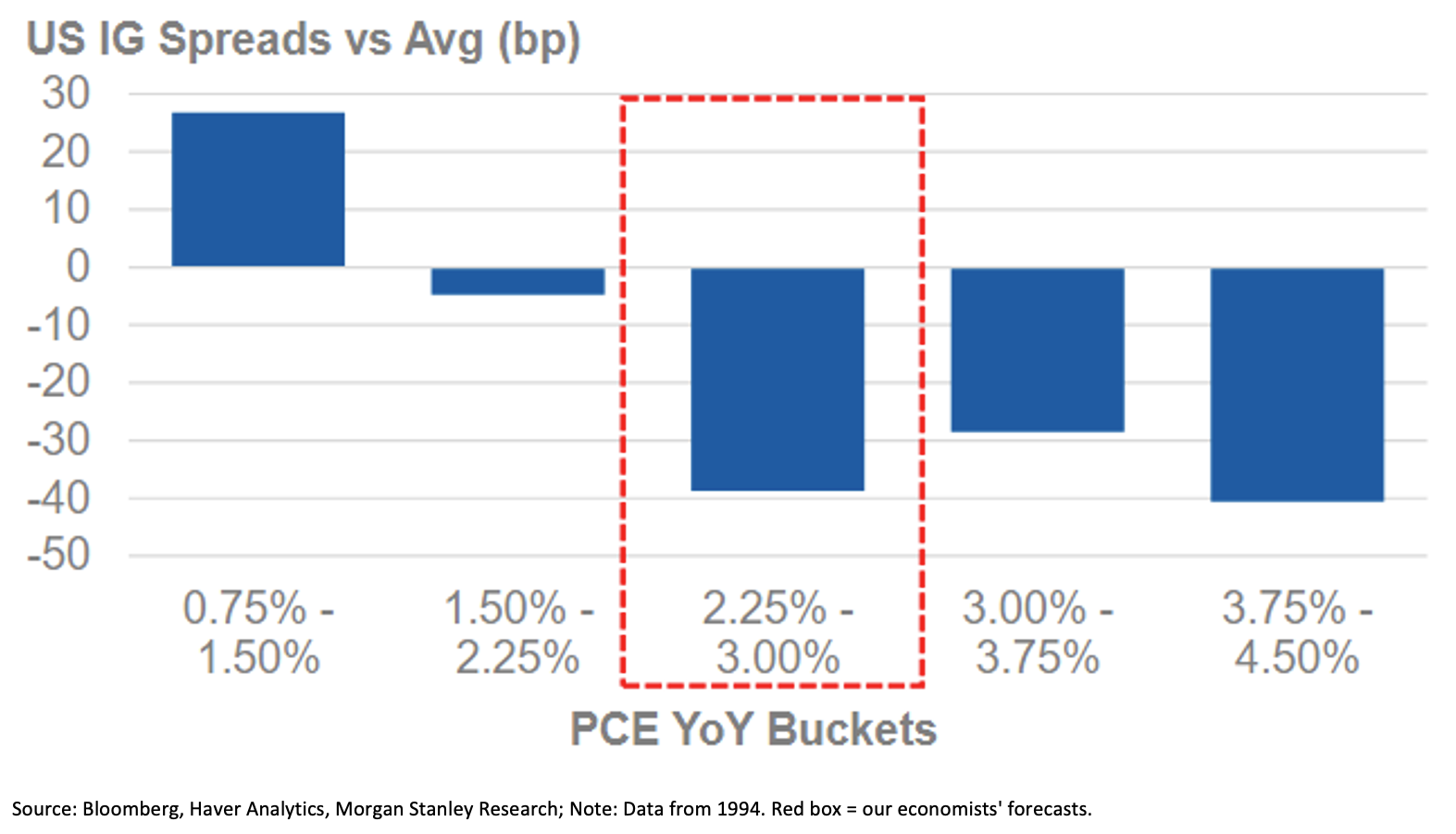

Credit

The fundamental and technical backdrop for Credit remains much better than average, likely supporting tighter-than-average spreads. The mid-1990s ‘soft landing’ remains our base case, and an ideal scenario for Credit. Loans offer the best risk/reward in the US and Europe. Securitized credit should rally as the Fed lowers interest rates and concerns regarding a recession fade.

Figure 5: Even if inflation is higher than our base case, US spread products should see lower spreads than average

FX Markets

We see the US Dollar Index rising to 109 by 3Q24 as policy divergence becomes an important theme. Higher potential risk premium priced for the 2024 US election is an additional tailwind for the US dollar (USD). The Australian dollar (AUD) will likely be a strong performer owing to the mix of hawkish monetary and expansionary fiscal policies. The RBA is likely to be the last G10 central bank to begin cutting rates which potentially limits AUD/USD’s downside in 3Q24 and sees it rising to 0.67 by year-end.

Commodities

In energy, we expect northern hemisphere summer tightness to drive Brent back to US$90/bbl. In metals, copper is our top pick. This preference is driven by a tightening supply-demand balance on significant mine supply disruptions, better-than-expected demand and new drivers such as data centres. Gold is also expected to perform well despite rising real yields, with rate cuts usually a tailwind for the gold price.

CROSS ASSET POSITIONING

We continue to build our equity allocation towards a mild Overweight given the constructive 12-month outlook. Momentum remains strong and markets prefer a weaker macro/inflation backdrop as long as recession concerns don’t re-emerge. Japan and Europe, where growth is picking up, along with the Quality factor remain our preferred exposures within equities. Australia’s performance is expected to improve but returns are likely to keep lagging compared to global equities.

Regarding Government Bonds, we favour International over domestic given the ‘stickier’ inflation outlook in Australia. We retain our Overweight to Credit across floating rate exposures domestically and Fixed Income Investment Grade as well as Loans in the US. In the current environment we continue to like Alternatives the most and are positioning with a mix of commodities, including Gold, as well as hedge funds and select private investments to enhance returns, lower portfolio volatility and manage equity beta risk.