Morgan Stanley Wealth Management Research’s flagship multi-asset model portfolios reached their 10-year anniversary in April 2022. Throughout the many challenges and fluctuations in the market environment over this period, Morgan Stanley’s Core models across the Balanced, Conservative and Growth profiles have delivered solid performance.

10 years of attractive returns

Overall, the last 10 years have been relatively constructive for Australian multi-asset investors given the structural declines in the Australian dollar, bond yields, and relative strong equity markets. Over this period, global equities rose 13.6% p.a1 and Australian equities advanced 9.9% p.a.2 whilst Australian bonds grew 3.1% p.a.3 and global bonds were 3.5% p.a.4 higher. Underpinning this was low interest rates, which have helped keep asset prices up as financial markets have increasingly decoupled from the fundamentals of the economy.

With the above figures in mind, the average Australian ‘60/40’ balanced portfolio has done reasonably well, returning 6.2% p.a. over this 10-year period5. However, over this same period, our Core Balanced portfolio has outperformed, returning an average 8.1% p.a., and therefore exceeding the average comparable portfolio by 1.9% p.a. (see Figure 1) and was in the top 1% of its peer category.

Figure 1: Core Balanced Model Portfolio Investment Returns Since Inception

Source: Morningstar, MSWM Research. Results shown represent total return (including dividends). Past performance is no guarantee of future results. Figures may not sum due to rounding. The portfolio is hypothetical and does not include actual trades; results do not include transaction costs/fees. Return data from 18 April 2012 (inception) to 30 Apr 2022. The Peer Group is the Morningstar Australia Fund Multisector Balanced Category Average – refer to the Morningstar Category Average Methodology publication. For further details see Asset Allocation Insights: Core Balanced Model Portfolio Performance Updates for April 2022. Indexed at 100 at inception.

This outperformance is also consistent with our Conservative and Growth Core multi-asset portfolios over the 10 year period. Based on the Morningstar comparable peer data (i.e. Multisector Category Average):

- The Core Conservative profile outperformed all peers in its category and has never had a negative calendar year return.

- The Core Growth profile was close to the top quartile of its respective peer category.

The future of the 60/40 portfolio

While all of this is good news for investors, it’s backward looking. More important is the outlook for the future. With the recent reversal of key central bank monetary stimulus which has had a negative influence on both stocks and bonds, it is reasonable for investors to challenge the relevancy of the traditional 60/40 balanced portfolio model in the current environment. This question is particularly relevant as the risk of a US economic recession continues to rise.

At Morgan Stanley, we believe the traditional 60/40 portfolio is only tactically challenged, and these challenges will dissipate in the medium term. We believe the long-term structural advantages of a diversified multi-asset portfolio remain intact. Weakness in both bonds and equities simultaneously are extremely uncommon. Since 1990, this has occurred around 10% of the time in any given month and in less than 1% of 6-month rolling periods. Based on this historical perspective, and our own analysis, we don’t believe this period of dual weakness will persist. As the relationship between stocks and bonds normalises, we believe 60/40 will continue to be an appropriate foundation for portfolio construction.

A brightening investment horizon

The painful valuation adjustment since the beginning of this year has removed much of the excess built up over the last 13 years. Where valuations were previously quite stretched, value is now more evident in both bonds and equities. We believe investors can expect normalised returns on a balanced portfolio and in this context, the traditional balanced allocation remains particularly relevant for long term investors.

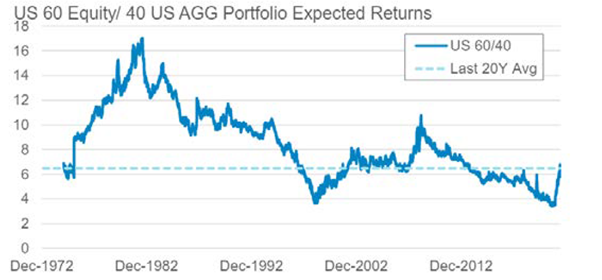

This outlook was also recently confirmed by Morgan Stanley’s cross-asset strategy team in the US who found that the returns for a USD-denominated 60/40 portfolio (i.e. a portfolio with 60% global equities and 40% US Aggregate bonds) stands at 6.6% - the highest since 2014, and slightly above the 20-year median level (see Figure 2).

Figure 2: US 60/40 equity/bond portfolio, highest expected returns since 2014.

Source: Morgan Stanley Research

If you would like to learn more about Morgan Stanley’s model portfolios and how you can implement a diversified asset allocation, speak to your Morgan Stanley Financial Adviser.